|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Reasons to Refinance Your Home: Exploring the Main Benefits and What to ExpectRefinancing your home can be a strategic financial move, offering various advantages. Understanding the key reasons to refinance will help you make an informed decision that aligns with your financial goals. Lowering Your Interest RateOne of the primary reasons homeowners refinance is to secure a lower interest rate. A reduced rate can lead to significant savings over the life of the loan.

For those residing in the Pacific Northwest, exploring options like seattle refinance mortgage can provide localized insights and opportunities. Changing Your Loan TermAdjusting the duration of your loan is another compelling reason to refinance. Shortening the Loan TermIf you are financially comfortable, switching from a 30-year to a 15-year mortgage can help you pay off your home faster, reducing the total interest paid. Extending the Loan TermConversely, extending your loan term can lower monthly payments, providing immediate financial relief. Switching from an Adjustable-Rate to a Fixed-Rate MortgageHomeowners often refinance to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, offering stability and predictability in payments.

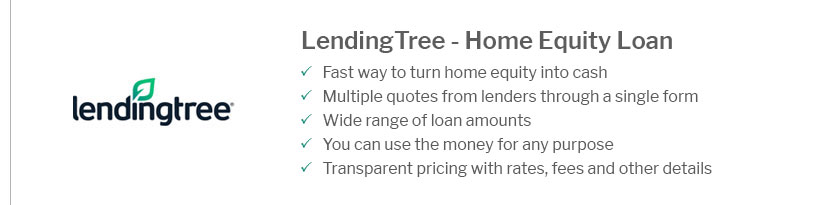

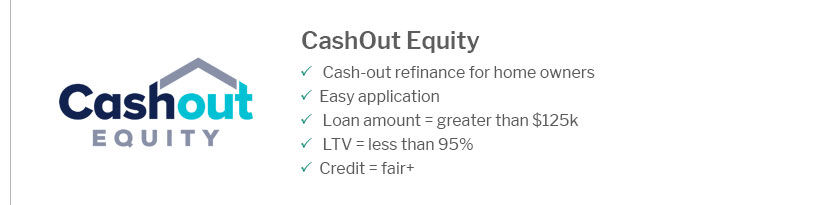

Accessing Home EquityRefinancing can also enable you to tap into your home’s equity, offering funds for various needs. Whether you're considering home improvements or consolidating debt, understanding second mortgage refinance options can be beneficial. FAQ SectionWhat are the costs associated with refinancing?Refinancing costs typically include application fees, appraisal fees, and closing costs. It's essential to compare these costs against the potential savings to determine if refinancing is worthwhile. How does my credit score affect refinancing?A higher credit score can lead to better interest rates and terms when refinancing. Lenders assess your creditworthiness, so maintaining a good credit score is crucial for favorable refinancing options. Can refinancing help with debt consolidation?Yes, refinancing can be used to consolidate high-interest debt into a single, lower-interest payment, potentially easing financial burdens and simplifying payments. https://www.cmgfi.com/refinance/reasons-to-refinance

Refinancing your mortgage could help you lower your mortgage rate, remove mortgage insurance, pay off your mortgage faster, or get cash out to cover other ... https://www.gatecity.bank/education/articles/7-reasons-to-refinance-your-mortgage/

If you've paid off a significant chunk of your mortgage, or if your home's value has increased, your LTV will probably be smaller and you'll have built more ... https://www.bankatfirstnational.com/wallet-wise-blog/june-2022-(1)/refinance-home-reasons/

6 reasons for refinancing your home - You can lower your interest rate. - You can pay off larger debts, like medical expenses or student loans. - You can use ...

|

|---|